Usda loan pre approval calculator

Use our USDA loan calculator to estimate closing costs figure monthly payments. USDA Rural Developments Section 502 Direct Loan Program provides a path to homeownership for low- and very-low-income families living in rural areas and families.

Do You Know How To Calculate A Usda Monthly Payment Usda Loan Pro

Although both denials hurt each one requires a different game plan.

. Pros of the USDA Rural Development Loan. This a conditional guarantee from a lender to formally offer you a mortgage. Loan preapproval and loan approval are two very different things.

Hometown Lenders is licensed under the laws of the State of Texas and by state law is subject to regulatory oversight by the Texas Department of BankingTexas Mortgage Banker Disclosure - Figure. In the US the Federal government created several programs or government sponsored. Or BER PITI all other monthly debt payments annual pre-tax salary 12 The above calculator gives you all the answers you need in one stop determining your front- and back-end ratios and compares it to the interest rate on the loan and the length of the loan.

RD and FSA electronic services for loan status and default status reporting. 7 TAC 81200c CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A MORTGAGE BANKER OR A LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATOR. Business loans come with.

Having a mortgage loan denied at closing is the worst and is much worse than a denial at the pre-approval stage. Interest rate when modified by payment assistance can be as low as 1. 2022 USDA mortgage May 17 2022 Mortgage discount points explained January 13 2022 You Dont Need A 20 Downpayment To Buy A Home February 20 2019.

Fixed interest rate based on current market rates at loan approval or loan closing whichever is lower. Mortgage pre-qualification does not guarantee that you will get a mortgage. Mortgage points or discount points are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment.

USDA Farm Bill A collective effort by all USDA agencies to explain the farm bill provisions and how they affect you. Biltmore Lane Madison WI. Pre-approval and conditional approval are.

The loan term is a 30-year fixed-rate mortgage. No down payment option 100 financing No cash reserves required. Pre-approval is subject to a satisfactory appraisal satisfactory title search and no meaningful change to borrowers financial condition.

When you get your pre-approval letter you can start looking for homes in. Mortgage pre-qualification is a written statement from a lender stating the loan amount you would qualify for according to that lenders guidelines. 2 If the loan amount is more than 80 of the homes purchase price the calculator will also estimate a monthly amount for private mortgage insurance PMI.

This is especially true if youve previously opted out. An underwriter is the one who grants or denies your loan so conditional loan approval from an underwriter carries more weight than a pre-approval letter. A business loan provides necessary financing business owners can use for everyday operations working capital purchasing equipment or inventory and paying other debts.

USDA Rural Developments Section 502 Direct Loan Program provides a path to homeownership for low- and very-low-income families living in rural areas and families. Flexible credit and qualifying guidelines. BER PITI all other monthly debt payments monthly pre-tax salary.

Whether in the beginning or end reasons for a mortgage loan denial may include credit score drop property issues fraud job loss or change undisclosed debt and. After pre-qualification you must obtain pre-approval. Seller can pay closing costs.

620 for manual underwriting but processing is longer. 3 This calculator is made available by one or more third party service providers. Interest rate when modified by payment assistance can be as low as 1.

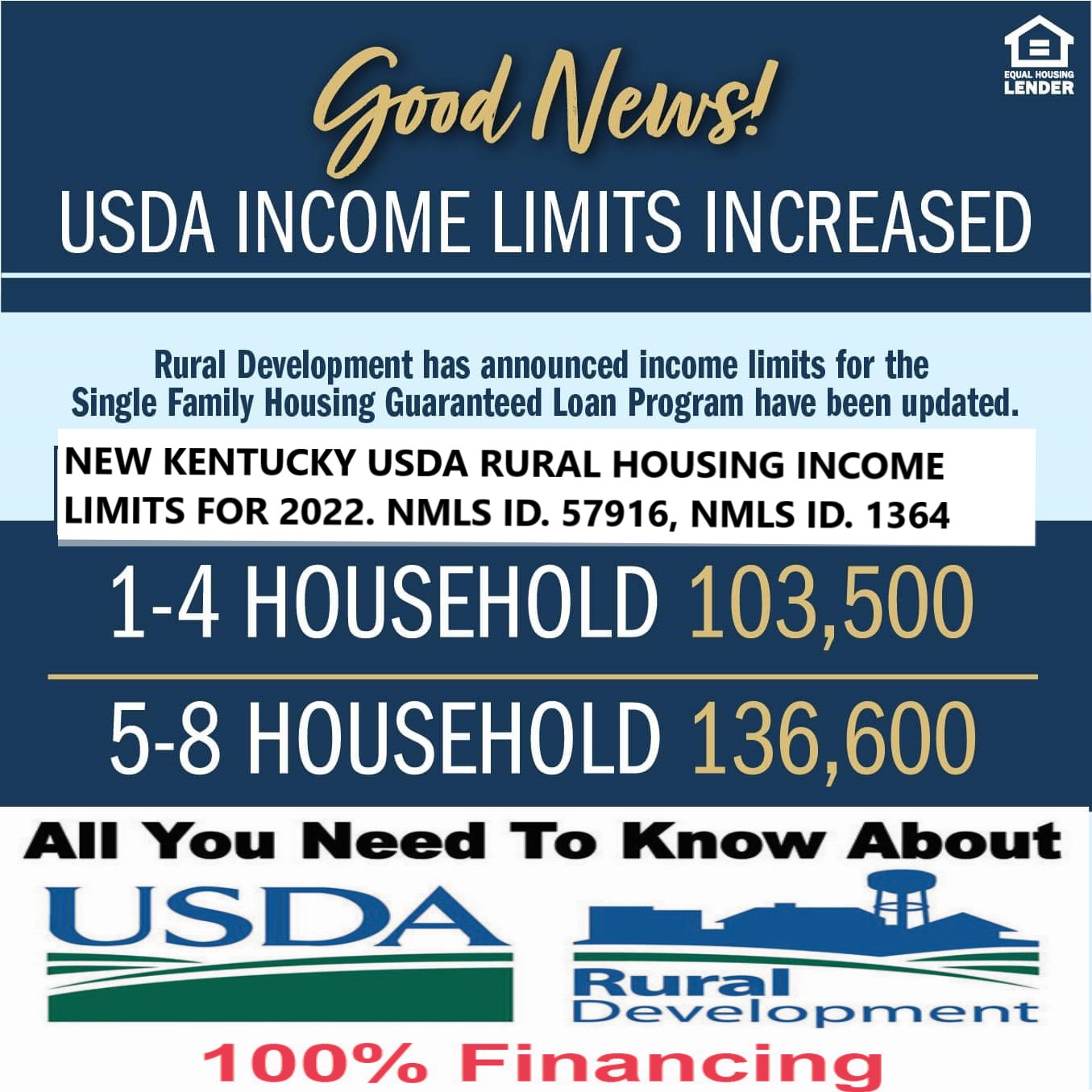

Use this FICO Loan Savings Calculator to double-check scores and rates. USDA eligibility and income limits. Low fixed interest rate.

It is not. But with loan preapproval youll know what you can afford under realistic financial conditions and be able to make. Fixed interest rate based on current market rates at loan approval or loan closing whichever is lower.

USDA eligibility and income limits. So that the calculator bases your loan limit on the back-end limit you enter. Just like pre-approval doesnt make your application a sure bet a lack of pre-approval doesnt mean an automatic rejection either.

A pre-approval does not constitute a loan commitment or guarantee of a loan. The determination and loan amount are based on your self-reported income and credit information. 2022 USDA mortgage May 17 2022 Mortgage discount points explained January 13 2022 You Dont Need A 20 Downpayment To Buy A Home February 20 2019.

To be sure loan preapproval isnt any kind of guarantee of financing. Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders. Multi-Family Housing Partners Provide your project budget and tenant residency status information online.

The rates shown above assume you have a FICO Score of 740 and a 20 down payment that the loan is for a single-family home as your primary residence and that you will purchase up to one mortgage point. Texas Consumer Complaint Recovery Fund Notice. Ability to finance repairs and closing costs into loan.

1 Certain program and geographic restrictions may apply ask your loan officer for details. USDA loan programs are provided to potential home buyers through the United States Department of Agriculture USDA to give people in rural communities a chance to become homeowners. Heres a list of documents that you need to present to be pre-approved or to secure final loan approval before closing.

For licensing information go to.

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Usda Loan Calculator For First Time Home Buyers In Rural Areas

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Usda Rural Housing Kentucky Loan Information

Usda Home Loan Process Step By Step Cis Home Loans

What Is A Usda Loan Pacres Mortgage

Kentucky Usda Rural Housing Loans How To Search For Kentucky Usda Properties Using T Usda Loan Usda Mortgage Lenders

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Do You Know How To Calculate A Usda Monthly Payment Usda Loan Pro

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Usda Loan Calculator For First Time Home Buyers In Rural Areas

Usda Versus Fha Loan Program Comparison

Usda Home Loan Qualification Calculator Freeandclear

Usda Loan Pro

Is Your Lender S Usda Approval Time Affected By Usda S Fiscal Year End Usda Loan Pro

Mortgage Pre Qualification Vs Mortgage Pre Approval The Ultimate Guide

![]()

Usda Rural Development Home Loans Calculator Usda Mortgage Eligibility Rates Amp More