Lump sum loan repayment calculator

Honeymoon rates vs on-going rates. Use this calculator to.

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien.

. Purchasing a home is a substantial commitment and our mortgage time calculator can give you an estimate of how long it will take you to be mortgage-free. You get a lump sum upfront. The minimum sum required to initiate the prepayment of your home loan with Bajaj Finserv is the equivalent of three of your EMIs.

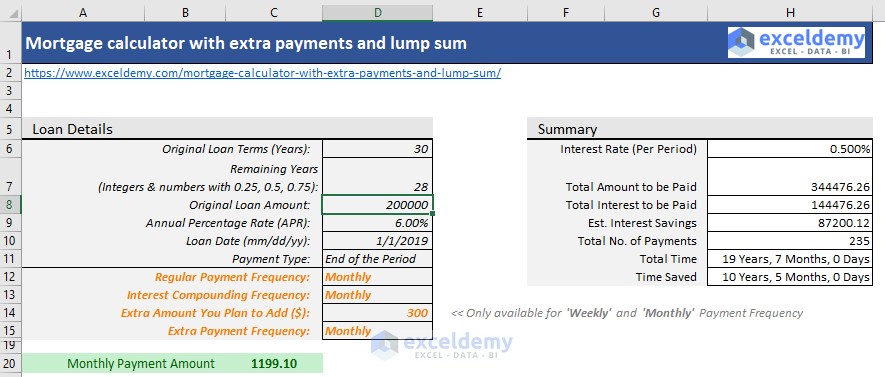

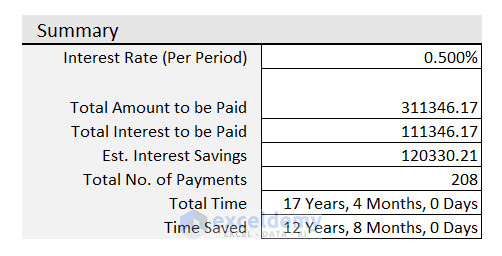

For instance if you defer 25 of a 30000 loan you will need to pay 7500. When youre comparing home loan repayments you need to make sure youre considering. This free online mortgage amortization calculator with extra payments will calculate the time and interest you will save if you make multiple one-time lump-sum weekly quarterly monthly andor annual extra payments on your house loan.

Unlike the first calculation which is amortized with. Single Lump Sum Due at Loan Maturity. Interest rates and other costs can change over time affecting the total cost of the loan.

The results provided by this calculator are an estimate only and should not be relied upon for the purpose of making a decision in relation to a loan. Your principal should match up exactly with the original loan amount. By wiping out a big chunk of principal your total interest savings will skyrocket because of the compound effect.

Free personal loan calculator that returns the monthly payment real loan cost and the APR after considering the fee insurance interest of a personal loan. This calculates how your savings will grow over time and the impact of compound interest. Use our extra and lump sum repayment calculator to see how making extra repayments can reduce your loan amount.

This is a lump sum payment payable to the lender at the end of your loan term. If youve received a lump-sum payment from an inheritance tax refund or commission from a sale youre probably considering how to best use the money. This calculator will help you to measure the impact that a lump sum repayment made at a certain period into the loan will have on the length of your mortgage and the total interest paid.

Choose the frequency. The second remainder of the principle is due at the end of the fixed loan term and is. Use our lump sum savings calculator to work out how much your savings could be worth in the future.

Get a quick estimate of how much you can borrow and what your monthly repayments will be with our easy car loan calculator. A mortgage in itself is not a debt it is the lenders security for a debt. Many commercial loans or short-term loans are in this category.

There are two car loan calculators for you to use at RateCity. Making a lump sum payment particularly in the early years of your loan can have a big effect on the total interest paid on the loan. What can a car loan Repayment Calculator tell me.

This financial planning calculator will figure a loans regular monthly biweekly or weekly payment and total interest paid over the duration of the loan. Youll also repay the loan sooner freeing up extra cash at the end. The payment is applied during the third year of the loan.

Your payments should match the total cost of the loan from the mortgage calculator. A balloon car loan is made up of 2 different loan repayment components. If they match youve done the formulas correctly.

Find out how much your home loan repayments will be and the total interest charged for the loan. Loan repayments are based on the lowest interest rate either standard variable or 3-year fixed rate owner occupier from our lender panel over a repayment period of 30 years. Your Investors mortgage loan will transfer to Citizens on Oct.

The results from this calculator are an approximate guide only and do not constitute specialist advice. This is taxed as income but in a special way unlike. Mortgage Original Loan w Extra Lump Sum Payment.

The first is a regular periodic repayment over the term of the loan that pays off a portion of the principle. Rates and repayments are indicative only and subject to change. Cross-reference these values with your mortgage calculator.

A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. At the bottom of the table sum the payments interest and principal. If youve decided to work on paying off your debt remember that early lump sum payments make a big difference.

Simply enter the loan details into the mortgage calculator below to see projected mortgage payments based on the type of home loan and your mortgage repayment frequency. The following chart shows how much you can save based on a one-time lump-sum payment of 60000. This student loan lump sum payment calculator shows how much you save and how much faster you pay off your student loans when you make a lump-sum payment.

The less principal involved in a debt the less interest youll pay. Early Lump Sum Repayments Make A Big Difference. So you make smaller loan payments to begin with and then pay a large lump sum at the end.

What if I made a single lump-sum payment of. The Loan Repayment Calculator is designed to provide an estimate of payments and results received from this calculator are designed for informational purposes. They should appear as a lump sum in a checking account supplied during the initial application as many lenders require an account to send personal loan funds via direct deposit.

An offset account is an everyday banking account thats linked to your home loan where you can deposit your savings and your regular wages. This calculator requires you to input your home loan amount and your repayment frequency - monthly fortnightly or weekly - to calculate the estimated length of your loan. You could be paid off in years or payments months early.

To see how this works lets compare a loan with one that has an lump sum payment of 50000. Since you pay a part of your dues before times a prepayment can result in a reduced tenor or a reduction in your EMI. What if I paid an additional per month.

Full usage instructions are in the tips tab below. When might I receive a state pension lump sum. You may also be interested in our monthly savings calculator.

Our mortgage calculator makes it easy to find out what the monthly fortnightly and weekly repayments will be for any loan. Top Picks For Student Loan. If you reached state pension age before 6 April 2016 and deferred receiving your state pension for at least 12 months in a row you can choose to receive a one-off lump sum in addition to your regular state pension when you later decide to draw your state pension.

It is an instalment payment before its due date and is usually a lump sum amount. The Repayment Calculator and the Borrowing Power Calculator. Keep in mind that.

The other way to make extra repayments into your loan is by using an offset account. Home Loan Comparison Calculator. Different amounts and terms will result in different comparison rates.

Free loan calculator to find the repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds. Prepayment refers to the early repayment of a loan. Home Loan Repayment Calculator Loan Payment Calculator.

Our calculator above can estimate other payment schedules such as weekly quarterly and annual payments. Extra charges such as Lenders Mortgage Insurance LMI loan features that allow for extra repayments. If you refinance 30000 of student loans at a 325 interest rate with a 10-year repayment term you can save 4789 over the life of your loan.

Consider whether you need financial advice from a qualified adviser. Fixed rate bonds - a. 30-Year Fixed Mortgage Principal Loan Amount.

Extra Lump Sum Payment. Costs such as redraw fees or early repayment fees.

Mortgage With Extra Payments Calculator

Extra Payment Calculator Is It The Right Thing To Do

Extra Payment Mortgage Calculator For Excel

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Extra Payment Calculator Is It The Right Thing To Do

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Loan Calculator That Creates Date Accurate Payment Schedules

Mortgage Payoff Calculator With Extra Payment Free Excel Template

Extra Payment Calculator Is It The Right Thing To Do

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Balloon Loan Calculator Single Or Multiple Extra Payments

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Loan Repayment Calculator